10 Things to Know About New Mexico Film Tax Credits

By ERMW Team

Thursday, July 3, 2025

New Mexico has solidified its position as a major player in the film and television industry, largely due to its robust and highly competitive film tax credit program. These incentives are designed to attract productions, stimulate the local economy, and foster a sustainable creative ecosystem within the state. Here's a more in-depth and up-to-date look at 10 key things to know about New Mexico's film tax credits:

1. A Powerful Incentive for Production Companies

New Mexico's film tax credits are a refundable incentive, meaning that even if a production company doesn't have a New Mexico tax liability, they can still receive a cash refund for the credit amount. This makes the program particularly attractive, as it provides direct financial benefits regardless of the company's in-state tax obligations. The base credit amount is 25% of qualified expenditures.

2. Driving Economic Growth and Job Creation

The primary goal of these tax credits is to draw film and television projects to New Mexico, which in turn injects significant capital into the state's economy. This translates into job opportunities for a diverse range of professionals, from crew members and actors to service providers and local businesses that support the industry. The film industry has become one of New Mexico's fastest-growing sectors, with over $5.75 billion in production spend in the state to date.

3. Significant Reductions in Production Costs

The ability to receive a refundable tax credit of up to 40% on eligible in-state expenditures can drastically reduce a production company's overall costs. This financial advantage makes New Mexico an incredibly appealing location, allowing filmmakers to allocate more resources to creative elements and production quality.

4. Broad Applicability Across Production Types

The New Mexico film tax credit program is comprehensive, covering a wide array of film and television productions. This includes:

Feature films

Independent films

Television series (including pilots and reality TV)

Commercials (national and regional)

Documentaries

Animation

Video games

Music videos

Virtual Reality (VR) and New Media

5. Clear Eligibility Requirements and Uplifts

To qualify for the credits, productions must meet specific criteria. The base credit is 25% of qualified expenditures, which include direct production and post-production expenses incurred in New Mexico. Beyond the base, several "uplifts" can increase the credit percentage:

Series Television & Standalone Pilots: An additional 5% for television series with an order of at least six episodes per season and a New Mexico budget of at least $50,000 per episode, or for standalone pilots intended for series.

Qualified Production Facilities (QPF): Another 5% for utilizing certified soundstages or standing sets within New Mexico.

Filming Uplift Zone (Rural Incentive): A significant 10% additional credit for qualified expenditures in areas at least sixty miles outside of Santa Fe and Albuquerque City Halls, encouraging production in more rural parts of the state.

These uplifts mean that a production could potentially receive up to a 40% refundable tax credit.

6. Capped but Substantial Payouts

While the New Mexico film tax credit offers substantial benefits, there is an annual fiscal year cap on the total amount of credits that can be paid out. For Fiscal Year 2025 (starting July 1, 2024), the Allowable Fiscal Year Film Fund Cap is $130 million. This cap is designed to increase incrementally, reaching $160 million by FY2029 and onward, demonstrating the state's continued commitment to the industry.

7. Specifics on Labor and Artist Credits

The program incentivizes local hiring. Wages paid to New Mexico residents fully qualify for the credit. For non-resident personnel, there are specific rules:

Non-Resident Performing Artists: Payments for non-resident principal performing artists are capped at $5 million per production. However, there's no cap for resident artists.

Non-Resident Below-the-Line Crew Exception (NRCE): A 15% credit is available for wages paid to a limited number of non-resident below-the-line crew positions, capped at 15% of total budgeted New Mexico below-the-line crew wages.

8. Registration and Application Processes

Productions must register with the New Mexico Film Office at least 30 days prior to the start of principal photography in the state. The final application for the tax credit must be submitted to the Taxation and Revenue Department within one year of the last qualified expenditure. For credit claims exceeding $5 million, an audit conducted by a New Mexico-licensed CPA is required.

9. A Track Record of Success and Continued Growth

The consistent popularity and competitive nature of New Mexico's film tax credits have transformed the state into a thriving hub for film and television production. This success has attracted major projects like "Breaking Bad" and "Stranger Things," leading to a robust local crew base and a flourishing film community. The economic return on investment (ROI) for the program is impressive, with an estimated $8.40 generated in the state's economy for every $1 invested.

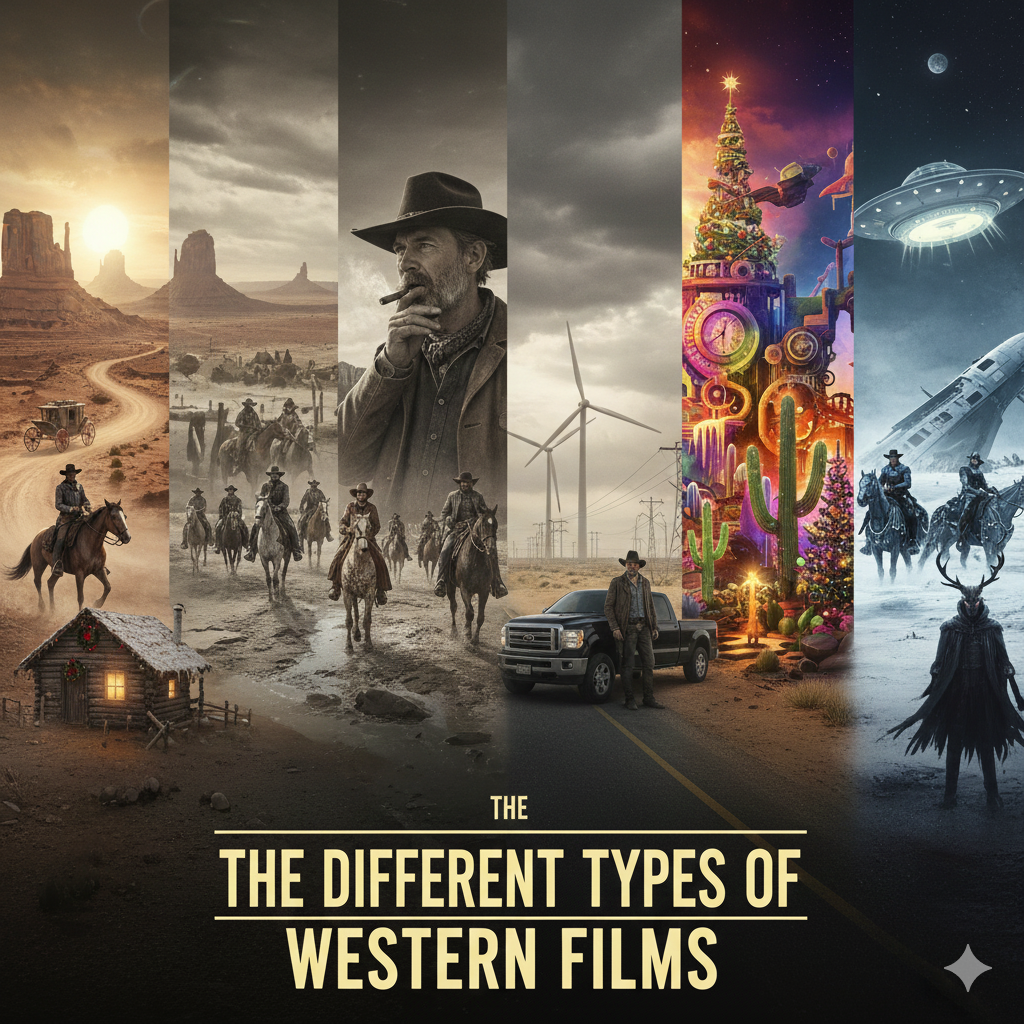

10. Beyond the Credits: New Mexico's Natural Appeal

Beyond the significant financial incentives, New Mexico offers a unique and diverse landscape that serves as a stunning backdrop for storytelling. From dramatic deserts and captivating mesas to towering mountains and vibrant urban settings, the state provides a versatile array of locations, further enhancing its appeal as a premier filming destination. The New Mexico Film Office plays a crucial role in marketing the state, servicing productions, and promoting job opportunities for New Mexicans, solidifying the state's position as a film-friendly environment.

For the most precise and up-to-date information, it is always recommended to consult the official New Mexico Film Office website (nmfilm.com) and the New Mexico Taxation and Revenue Department.